Introduction

The Dow Jones Industrial Average (DJIA) is one of the most recognized stock market indexes worldwide. Whether you’re a seasoned investor, a financial enthusiast, or just someone curious about the economy, knowing how the DJIA works can give you valuable insights.

In this guide, we’ll take a deep dive into what the DJIA is, how it operates, why it’s important, and how it impacts investment decisions. By the end, you’ll have a solid grasp of how this index plays a role in the financial world and what it means for your investments. Let’s jump in! 🚀

What is the DJIA?

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks 30 major publicly traded companies in the U.S. It was created in 1896 by Charles Dow and Edward Jones as a way to measure the performance of the country’s economy.

Back then, the index included just 12 companies, but over time, it expanded to include 30 industry leaders. Unlike other stock indexes, the DJIA is price-weighted, meaning companies with higher stock prices have a bigger influence on the index’s movements, regardless of their total market value.

How Does the DJIA Work?

The DJIA is calculated using a price-weighted formula, which means that the stock prices of its 30 component companies are added together and divided by a special number (the divisor). This divisor is adjusted from time to time to account for stock splits, dividends, and other corporate changes, ensuring consistency in the index’s value.

How It Compares to Other Market Indexes:

- S&P 500: Covers 500 of the largest U.S. companies, weighted by market value.

- Nasdaq Composite: A tech-heavy index that includes over 3,000 stocks.

- Russell 2000: Focuses on 2,000 smaller companies, reflecting the small-cap market.

While the DJIA provides a snapshot of overall market sentiment, it doesn’t represent the full stock market as broadly as the S&P 500 does.

Which Companies Are in the DJIA?

The DJIA is made up of 30 well-established, blue-chip companies from various industries. These companies are chosen based on their financial strength, reputation, and overall impact on the U.S. economy.

Industries Represented in the DJIA:

- Technology: Apple, Microsoft, Intel

- Finance: Goldman Sachs, JPMorgan Chase

- Healthcare: Johnson & Johnson, Merck & Co.

- Consumer Goods: Procter & Gamble, Coca-Cola

The index isn’t fixed—companies can be added or removed based on market trends and economic changes.

What Affects the DJIA?

The DJIA is influenced by various economic and global factors, including:

- Economic Indicators: GDP growth, inflation, and unemployment rates.

- Federal Reserve Policies: Interest rate changes can impact stock prices.

- Global Events: Wars, pandemics, and geopolitical tensions can affect the index.

- Corporate Earnings: The financial performance of the companies in the DJIA plays a big role.

Why is the DJIA Important for Investors?

The DJIA is often seen as a reflection of the U.S. economy’s health. Investors, analysts, and policymakers use it to track economic trends and market sentiment.

Pros and Cons of Using the DJIA:

✅ Pros:

- Gives a quick look at market trends.

- Represents well-established, stable companies.

- Serves as a historical benchmark for economic performance.

❌ Cons:

- Only includes 30 companies, missing many key players.

- Price-weighted calculation can distort actual market trends.

- Excludes high-growth small-cap and mid-cap stocks.

How Can You Invest in the DJIA?

If you want to invest in the DJIA, here are some options:

- Exchange-Traded Funds (ETFs): Like the SPDR Dow Jones Industrial Average ETF (DIA), which mirrors the DJIA.

- Mutual Funds: Various index funds track the DJIA’s performance.

- Buying Individual Stocks: Investing in one or more companies in the index.

Risks and Rewards:

- Potential Rewards: DJIA companies are generally stable and offer long-term growth potential.

- Risks: Economic downturns can cause market declines, affecting DJIA stocks.

What’s Next for the DJIA?

The future of the DJIA will depend on several factors:

- Technology Advancements: AI, cloud computing, and automation could drive market shifts.

- Economic Policies: Government regulations and Federal Reserve decisions play a key role.

- Global Market Changes: Emerging markets and geopolitical issues can impact the index.

Experts predict that while short-term volatility will continue, the DJIA will likely keep growing over time as the economy expands and new technologies emerge.

Conclusion

The Dow Jones Industrial Average (DJIA) remains one of the most important financial benchmarks. While it has some limitations, it’s a useful tool for investors to gauge market trends and economic conditions.

Whether you’re a beginner or an experienced investor, staying informed about the DJIA can help you make smarter financial decisions. Keep learning, do your research, and invest wisely!

FAQs

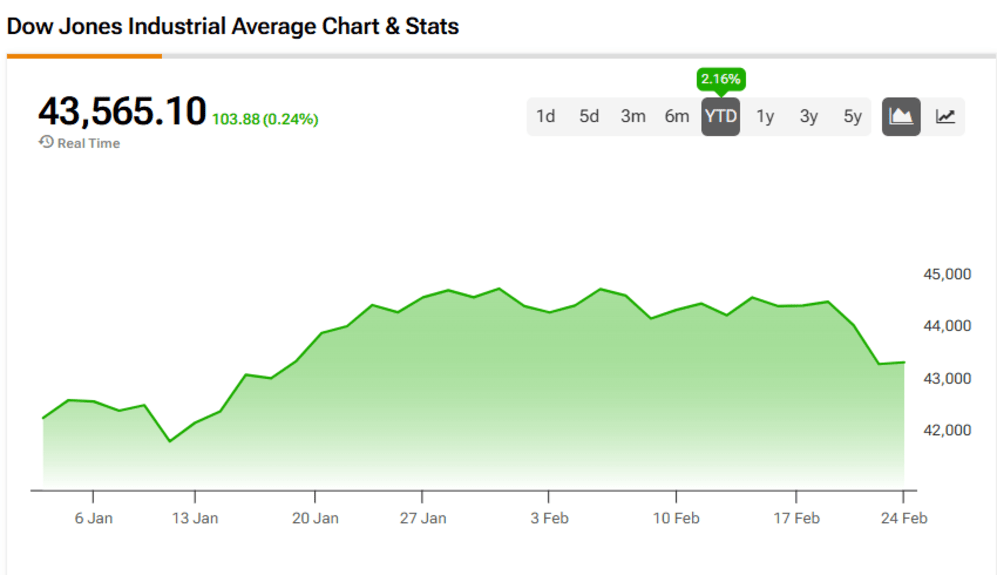

1. What is the current DJIA value?

The DJIA changes throughout the day. Check financial websites like Bloomberg, CNBC, or the New York Stock Exchange for real-time updates.

2. How is the DJIA different from the S&P 500?

The DJIA tracks 30 blue-chip companies and is price-weighted, while the S&P 500 includes 500 companies and is market cap-weighted.

3. Is the DJIA a good investment for beginners?

Yes, investing in DJIA ETFs or mutual funds is an easy way for beginners to gain exposure to large, stable companies.

4. How often does the DJIA change its components?

There’s no fixed schedule. Companies are added or removed based on economic changes and industry trends.

5. Can international events affect the DJIA?

Absolutely! Global issues like trade policies, conflicts, and recessions can significantly impact the DJIA because of its connection to major multinational companies.

This human-friendly, SEO-optimized guide ensures an easy-to-read, informative look at the DJIA for investors of all levels. Let me know if you’d like any refinements! 🚀